India’s evolving fintech landscape has hardly witnessed a raging chorus, with every stakeholder – from regulators to startups and lenders – pressing for a change in guidelines. That’s what is taking the country’s by 2030, by storm at the moment.

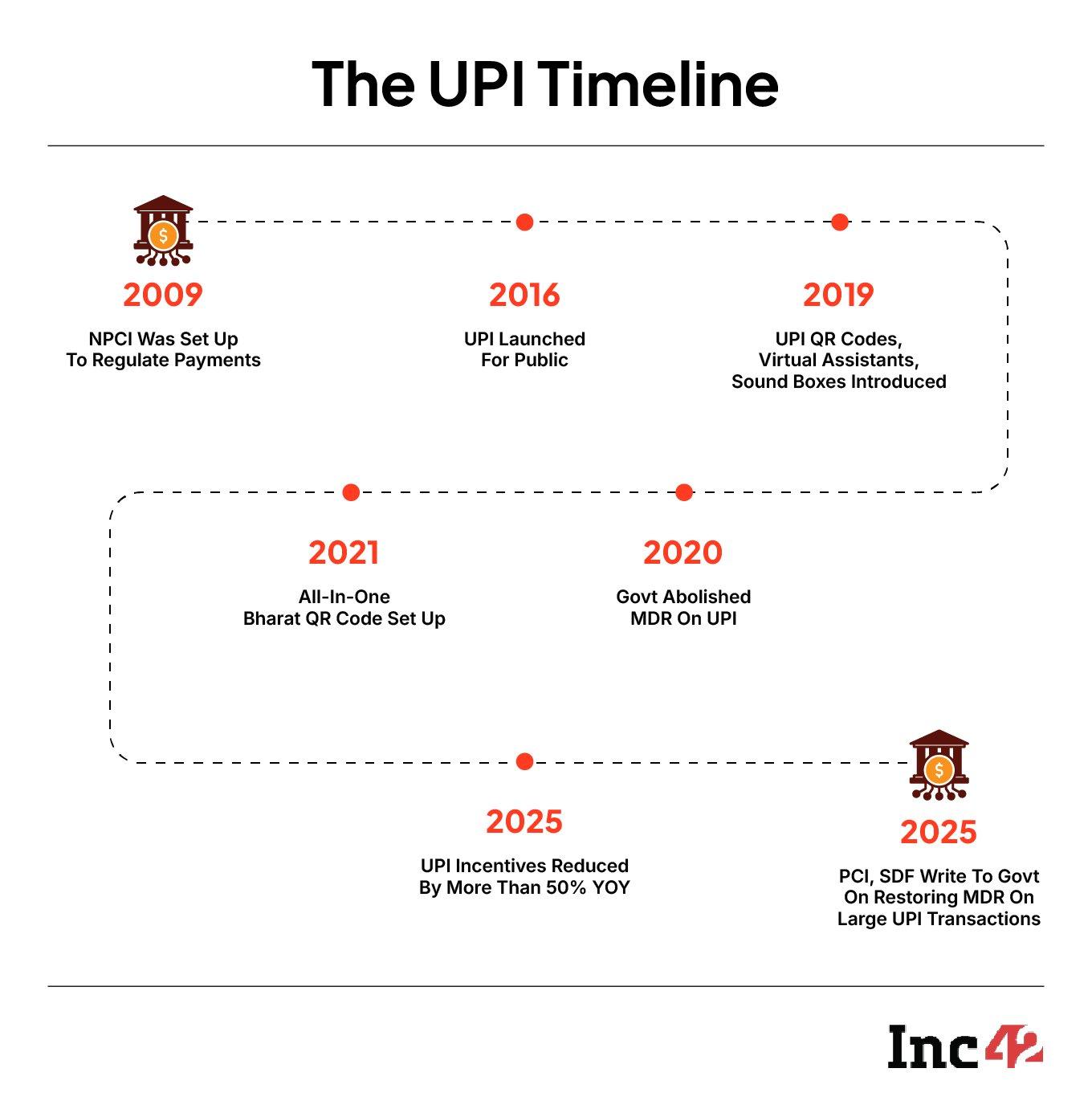

The stakeholders have reached out to Prime Minister Narendra Modi, seeking a green light to charge large merchants on any UPI transactions above INR 2,000. The Merchant Discount Rate (MDR), which is the fee charged to merchants by banks or payment service providers for processing digital transactions through the Unique Payment Interface (UPI), was brought down to zero from January 1, 2020, to push for digital payments.

But the need to bring back the MDR was amplified with UPI becoming the primary mode of retail payments and RuPay gaining traction, and the industry felt the blanket waiver was no longer necessary to drive digital payments.

On March 24, the Payments Council of India (PCI) in a letter to PM Modi sought urgent reconsideration of Zero MDR on UPI and Rupay debit card transactions. PCI is an industry body of members like Airtel Payments Bank, Amazon Pay, Google Pay, Cashfree, and Jio Payments Bank. PCI’s call to impose MDR on big-ticket transactions was , which counts Razorpay, Groww, and Zerodha as its constituent members.

They have called for an MDR of 0.3% on UPI payments above the ticket size of INR 2,000 for P2M transactions where merchants have an annual turnover of INR 20 Lakh. The two-tiered approach will balance growth with financial inclusion on one hand, while on the other, foster a sustainable ecosystem for digital payments space.

Banks had earlier requested the government to restore MDR on UPI payments for . In fact, various industry players have repeatedly demanded that MDR be restored.

The call for MDR turned louder even as some of the largest players in the ecosystem, especially third-party applications (TPAPs) like Google Pay, PhonePe, and Paytm, maintained an unusual silence on the issue. Together, Google Pay and Phonepe constitute more than 80% of the UPI transactions on a volume basis, while Paytm remains a distant third.

“While it is true that we have not heard much from the TPAPs on the MDR issue, there is no reason why they should not be supporting this, considering that it will not impact 90% of their transaction volume as the average transaction value for them is below INR 2,000,” Rajesh Londhe, cofounder, Phi Commerce, told Inc42.

The fintechs and some of the leading banks that have taken up the issue with the RBI have not found any resistance from the regulator. “What the industry has been told is that the regulator is awaiting clarity from the government on MDR and once that happens, the RBI and the NPCI will have no choice but to allow the acquiring banks and payment companies to charge MDR from large merchants,” he said.

An acquiring bank enables businesses or merchants to accept various types of transactions, including credit or debit cards and other digital payments.

Sources privy to the discussions among the banks, fintechs and the RBI indicated that the industry hopes to see an announcement from the finance ministry on MDR soon. The participation of some of the largest private lenders has strengthened the case in their favour.

With the chorus growing louder to reinstate MDR on UPI, we unpack what’s really driving the demand.

What Went Wrong In Zero MDR RegimeThe zero merchant discount rate regime was rolled out in January 2020 for RuPay Debit Card and BHIM-UPI transactions through amendments in Section 10A of the Payments and Settlement Systems Act, 2007 and Section 269SU of the Income-tax Act, 1961. The move was intended to accelerate digital payment adoption in the wake of the government’s 2016 demonetisation push towards a cashless economy.

Finance Minister Nirmala Sitharaman had backed the move, arguing that while the government imposed Zero MDR, the costs incurred in UPI payments were far lesser than the other modes of transactions.

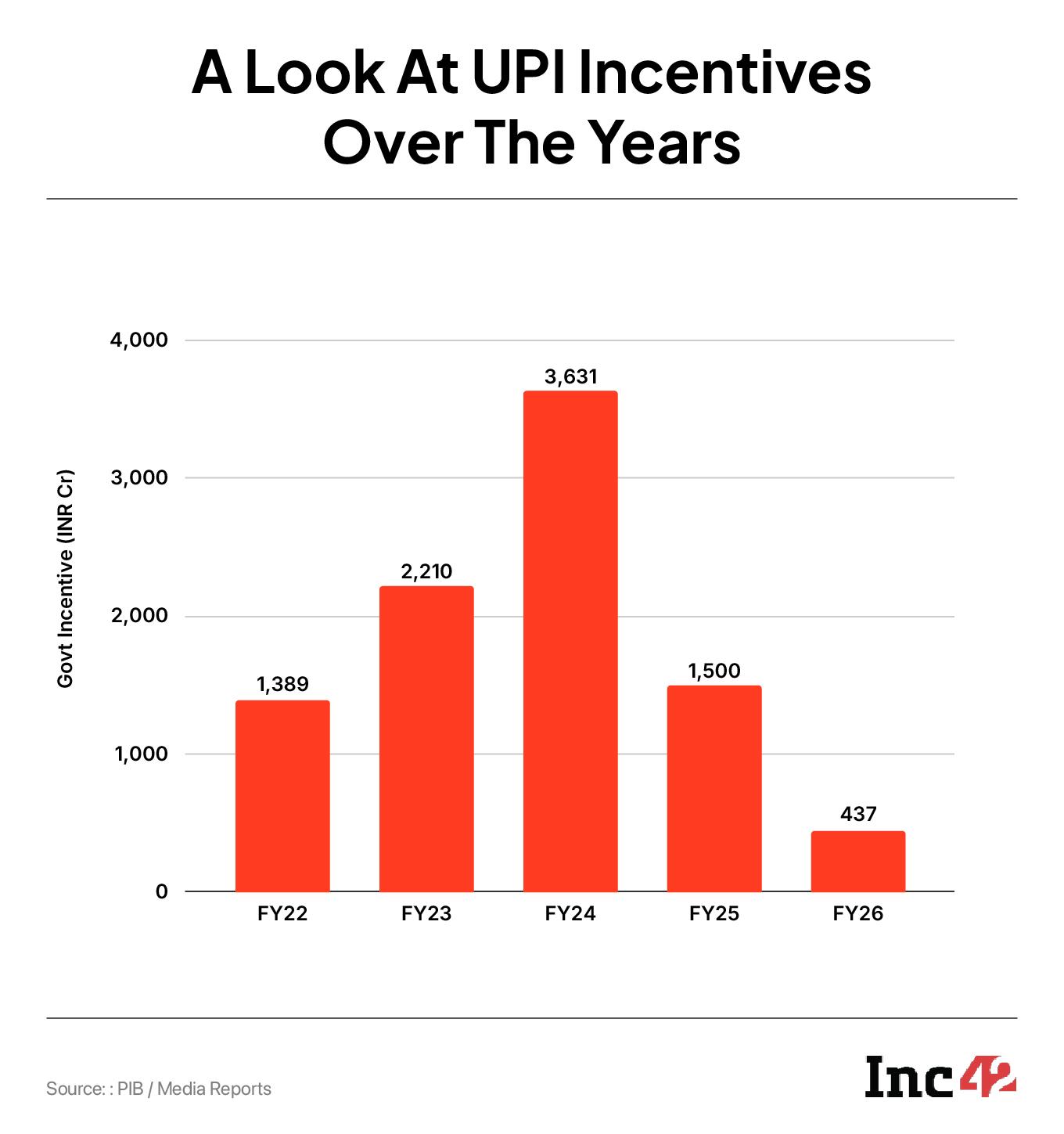

While the government did not allow banks and payment companies to charge MDR from merchants on any UPI transactions, it compensated banks, PSPs and TPAPs to the tune of , while there were no sops for big-ticket transactions.

The incentive payout stood at INR 1,389 Cr in FY22 and it went down to INR 2,210 Cr in FY23. The corpus was raised to INR 3,631 Cr in FY24, but was again brought down to . According to media reports, the allocation has been hacked down to .

While the government incentives slowed down, UPI transactions gathered momentum, emerging as the most preferred form of digital payments in India.

In . The UPI’s share in India’s digital payments pie stood at 83% in 2024 from 34% in 2019, averaging a growth rate of 74% in the five years, as per data collated from The National Payments Corporation of India (NPCI), which runs the UPI. Merchants payments constituted 62% of all UPI transactions.

Riding on the UPI wave, the government has signed agreements with various countries like France, Singapore, Maldives, and the UAE to develop UPI-like payment systems there and promote cross-border payments.

Banks and fintech players argued that some of the goals aimed at Zero MDR on UPI had been achieved, with Indian consumer habits also undergoing a seismic shift.

Why The Call To End Zero MDR Turned LouderOver the past couple of years, banks, payment processors, and even TPAPs have had to upgrade their tech stacks and bear server costs to accommodate exponentially rising UPI transactions.

“We have seen frequent outages because of technical issues faced by the NPCI, latency in the bank network, and such challenges. There were five reported UPI outages over the past one year across the country with NPCI attributing the same to some ‘intermittent technical issues’,” founder of a TPAP said.

While it isn’t certain as to what the specific technical challenges could be, industry analysts say that it has become unsustainable for fintechs and banks to keep up with the rising costs associated with UPI transactions under the current Zero MDR regime.

Some fintech founders complained that the government’s incentives for UPI players were never enough to cover the costs associated with transactions.

“It is crucial for payment companies to rely on sustainable models to whatever extent possible.This has been in the works for a while. The timing now seems right because the government has completed its initial digitisation and UPI groundwork. Now, the focus is on making the system sustainable while ensuring quality for those supporting it,” Rohit Taneja, founder and chief executive of Decentro, a banking integration platform for merchants, told Inc42.

“Banks, in particular, have been vocal about this. Any senior banker would say that while UPI is great for maintaining trust, it is incredibly costly. They are expecting better support and incentives from the government, which has been the broader discussion,” he added.

Taneja went on to add that government incentives cannot be a solution since banks and fintech will have to first spend on infrastructure costs to enable transactions, and then only the government incentives will cover the costs. “Moreover, these incentives have been heavily skewed towards a few players, and they clearly benefited the most,” Taneja added.

Zero MDR is not the only issue that has roiled the fintech space. The dominance of TPAPs like PhonePe and Google Pay has created an uneven field in the consumer-facing UPI apps market. Industry leaders have long argued that this is against competitive practices.

The NPCI had called for limiting the market cap of UPI for each TPAP to 30% of the market share, but over the last couple of years, for this.

Will MDR Restoration Be A Nemesis For UPI“Certainly not,” the founder of a Bengaluru-based TPAP platform ruled out the possibility of a downfall for the UPI in bringing back the merchant fees. “Our demand is only to charge big merchants for transactions above INR 2,000. Big-ticket transactions make up only 10% of the UPI volumes.”

PCI members Inc42 spoke to said the majority of the UPI volume is made up of micro-transactions, or those below INR 2,000. Also, the government incentives were for micro-transactions on the UPI and not large-ticket transactions. Since Zero MDR was a sweeping regulation, banks and payment companies weren’t charging merchants anything.

Rajesh Londhe of Phi Commerce argued that the demand of charging 0.3% on each big transaction would not necessarily impact merchant behaviour or lead them to opt for other payment methods.

“Merchants typically adopt the payment methods that consumers prefer. A decade ago, people asked for POS machines, but today, QR codes are the norm. The same will continue even after MDR is introduced. UPI adoption will not decline – it will simply create a more balanced ecosystem,” Londhe said.

There are murmurs in fintech circles that some payment gateway companies were charging a certain percentage of the transaction amount as a payment processing charge disguised as hidden fees or convenience fees.

“Once this merchant discount rate (MDR) comes into play, the concept of free UPI will no longer exist. Large merchants expect UPI transactions to be free, which puts pressure on PGs (payment gateways) to monetise through credit cards or offer additional services at very low margins – sometimes as low as 0.1% or 0.2%. This is not a sustainable solution,” Taneja said.

“Once the free aspect is removed, merchants can no longer expect free UPI transactions by default, since the government won’t mandate it. Each PG will develop its own pricing strategy. Some PGs may still choose to offer free UPI transactions, but it won’t be a universal rule.” he added.

The NPCI, however, negated the complaints of the payment service providers. The absence of MDR is not deterring new participants from joining the UPI ecosystem, NPCI managing director and chief executive recently, with 50 TPAPs keen on boarding the real-time payment rails.

What Keeps Third-Party Big 3 Silent On MDR IssueAs the demand to end the Zero MDR regime grows louder, the silence from the big three consumer-facing UPI apps — PhonePe, Google Pay, and Paytm — hasn’t gone unnoticed, especially in the wake of the government slashing incentives over the past month.

Some of the big TPAPs are also members of the PCI, which has been leading the rally against Zero MDR.

Although restoration of MDR on UPI is not likely to have any financial impact on these applications since most transactions are micro-transactions on these apps, these players are concerned that the merchants may pass on the costs being charged to the consumer that may, in turn, impact the userbase of these apps.

The MDR being proposed to be charged from merchants will be shared between the acquiring banks and the payment gateways, not the TPAPs. Only if a TPAP has its own payment gateway business, like PhonePe or Paytm, will it make revenue out of the MDR ambit.

“Google Pay doesn’t have its own PG business. PhonePe and Paytm’s PG businesses are small, compared to mature players. This regulation although would not impact them directly, there are concerns of a spill-over effect on the consumer behaviour if large merchants are charged and they pass it on to consumers.This could impact the UPI userbase which, in turn impacts these TPAPs,” the Bengaluru TPAP founder pointed out.

Any erosion in the user base would also concern the government, which has been promoting UPI on international stages.

What Lies Ahead For Debates And DeterrentsTaneja of Decentro believes that the larger concern with the government lies in the challenges faced by banks, including some of the biggest lenders, in maintaining the infrastructure associated with a huge volume of UPI transactions.

“The government is also concerned about the sustainability of banks. In an extreme scenario, there could be a major financial crash due to banks being unable to sustain the system. That would be a far bigger problem. So, banks are already spending heavily on maintaining the UPI ecosystem. That is why we have seen even the likes of HDFC Bank and several big lenders supporting this demand,” Taneja said.

Londhe of Phi Commerce, however, ruled out such a possibility, saying that the concerns of shifting consumer behaviour because of the reintroduction of MDR were unfounded since businesses cannot charge any additional convenience fee to the consumer without government approval.

“The kind of UPI transactions which will most likely come from the UPI purview will involve large merchants and enterprises who will be ready to absorb a 0.3% cost for a large transaction or to retain consumers and not pass it on,” said the founder of a large payments gateway startup that deals with enterprises.

Taneja added that in such transactions the majority of the volume gets generated by the top 1% or 5% of high-spending individuals in India. “Most of them wouldn’t mind paying a convenience fee of INR 1 or INR 2. BookMyShow is a great example. When you book tickets online, you pay an INR 90 convenience fee, yet people prefer booking online rather than going to the theatre in person,” he added.

While there is a lot of chatter going on within the banking and fintech circles across India over the MDR issue, all eyes are now set on the next big move by the government and whether FM Sitharaman would further reduce the MDR incentives to banks and fintechs in the FY27 from an allotment of INR 437 Cr in FY26 or altogether cut back on incentives and introduce MDR on large UPI transactions.

[Edited By Kumar Chatterjee]

The post appeared first on .

You may also like

Trump considers pausing his auto tariffs as world economy endures whiplash

'Poila Boishakh', PM Modi greets Bengalis on New Year Day

Chelsea's dream XI could include Liam Delap and £130m trio as Prem swap deal emerges

Horror as child, 11, waiting in queue for ice cream hit by truck in Howard City crash

61-day fishing ban begins in TN; fishermen urge vigilance against illegal trawling